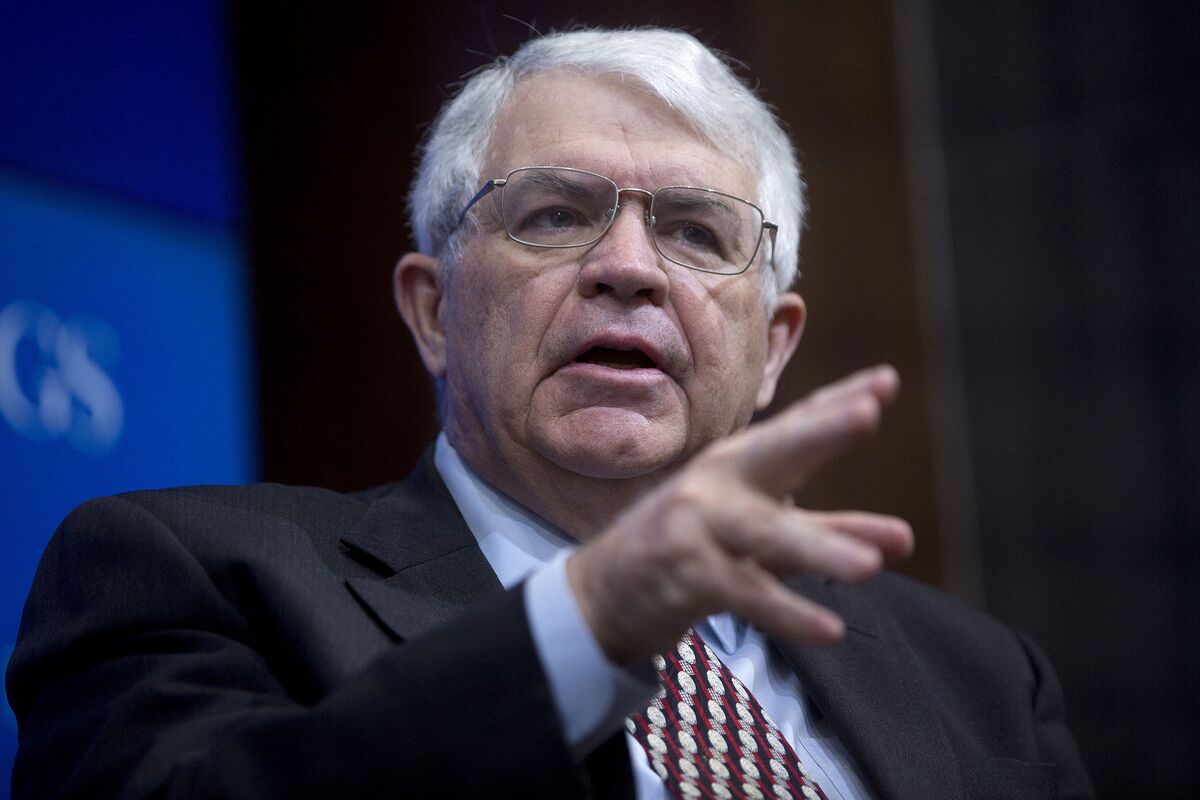

John Taylor, professor of economics at Stanford University, speaks during a panel discussion at the Brookings Institution in Washington, D., on Thursday, Oct. Monetary policy rules like the so-called Taylor Rule could lead officials to make mistakes because they aren`t forward-looking and they don`t incorporate key forces shaping the economy, said Federal Reserve Bank of New York President William C. Dudley at the event. Photographer: Andrew Harrer/Bloomberg *** Local Caption *** John Taylor

John Taylor has a complicated history with the U. Federal Reserve that could force him into a hard pivot if he’s selected as its next leader.

The Stanford University economist, who is on President Donald Trump’s short list to lead the central bank, wrote the monetary policy rule that Fed officials use as a constant reference, and many of the institution’s own economists are schooled in his ideas. On the other hand, he’s been a vocal critic of recent Fed policy, arguing that the institution should hew closer to the recommendations of his formula and be less discretionary in its policy setting.

Taylor would not be able to force an about-face overnight if he were Trump’s pick. The chair has only one vote on policy, and since former Chairman Ben Bernanke’s time at the helm, consensus has been the standard for decision-making. The current crop of central bankers generally reject Taylor’s world view as too rigid. That means as chair, Taylor would likely have to compromise, coax, and work within the existing, discretionary framework -- something of a turnabout for a man who is one of its leading critics.

“Whoever is the next Fed chair is going to have to work collaboratively,” said Tony Fratto, managing partner at Hamilton Place Strategies in Washington and a former U. Treasury Department official who worked closely with Taylor for several years. Of Taylor, he said, “Can he do it? Yes, I think he can do it. But I also think there’s no choice but to do it.”

History of Criticism

Trump told Fox Business that he’s considering Taylor, Federal Reserve Governor Jerome Powell, current Chair Janet Yellen, and a “couple of others” to lead the central bank. Yellen’s term expires in February. The Fox News interview will be broadcast Sunday and Monday. “I will make my decision very shortly,” Trump said.

Taylor, a frequent witness on Fed policy at the House Financial Services Committee, has mocked the Fed’s mortgage bond purchases as “mondustrial policy,” and as early as 2009 warned that the “enormous” increase in bank reserves would stoke too much inflation, a worry that hasn’t materialized.

Before Yellen, all three previous Fed chairs were reappointed by a president of another party, giving incumbents an advantage in their second term. For that reason, challengers position themselves as discontinuity candidates, said Sarah Binder, a senior fellow at the Brookings Institution and co-author of a new book on the Fed’s relationship with Congress.

The Fed “is being treated as a political institution, not that different than other institutions,” Binder said, adding that self-styled change candidates are running against the insiders.

That could play well in a White House that has appointed critics of agencies to lead them, such as Scott Pruitt, the current administrator of the Environmental Protection Agency. Some Republicans on the Senate Banking Committee, which has Fed oversight authority, have voiced a clear preference for getting rid of Yellen. Mike Crapo, the Idaho Republican who chairs the Senate panel, said in an Oct. 19 interview he “disagreed” with Fed policies such as quantitative easing and wants the central bank to “change direction.”

The Rule

Taylor has advocated for use of prescriptive policy rules in the wake of the financial crisis, like the one he set out in 1993. It now bears his name.

“World monetary policy now seems to have moved into a strategy-free zone," he wrote in 2015. In the same paper, he supported Republican-backed legislation requiring the Fed to adopt rule-based policy making that would have it explain any deviation to lawmakers.

Taylor “has supported just about every Fed reform proposal by House Republicans, to the displeasure of, I expect, everyone inside” the Fed system, said former Fed Governor Laurence Meyer, who now runs a policy research firm. “That raises the question of how successful would he be as a consensus builder and leader within the FOMC."

Fed policy makers regularly argue that subjecting the Fed to a rule -- and forcing it to explain deviations to Congress -- would curb independence and hurt the economy.

Hawkish Turn

What’s more, the rule, depending on the economic assumptions that are plugged into it, might call for several rate hikes: the baseline Taylor Rule model indicates policy rates around 3.75 percent, versus the Fed’s current target range of 1 percent to 1.

The Fed has deviated sharply from its suggested path in recent years as the post-recession economy has struggled to gain steam. It’s not clear whether Taylor would want to push rates up immediately, or whether he’d stick to the gradual path of increases the Fed is already treading.

Taylor indicated a willingness to be pragmatic during remarks at a Oct. 13 conference hosted by Federal Reserve Bank of Boston President Eric Rosengren. For his part, Rosengren said that “most people who end up being the chair, no matter who they are, tend to be a little bit more flexible in their thinking when they’re actually making the decision.”

One reason to diverge from the recommendations of the rule is that it would have been a poor guide during the financial crisis.

Policy was in a bind when officials cut rates to zero in 2008 following the collapse of investment bank Lehman Brothers Holdings Inc. The Taylor rule would’ve recommended dipping into negative territory during the recession, but policy makers worried that would harm the nation’s banks and cause a damaging public and political backlash.

Since 2012, applying the rule would have called for higher rates than the Fed has actually set -- arguably a wrong approach, since inflation has lagged and is still well under its 2 percent target.

To be fair, Taylor has always said his rule is a guideline, not a mechanical tool, and so the Fed could deviate from its prescriptions. They’d just need a good reason to do so.

The Fed already looks at rules, but to formalize that process by tying policy explicitly to one would be a major change, said Peter Conti-Brown, a Fed historian at the University of Pennsylvania’s Wharton School.

“It’s about the creation of a new consensus, and I don’t know that he has the skill-set to accomplish this,” Conti-Brown said. “John Taylor could be one of the most disruptive Fed chairs in its history, if he can persuade the internal actors within the system that all this time, he was right, and they were wrong.

0 comments:

Post a Comment