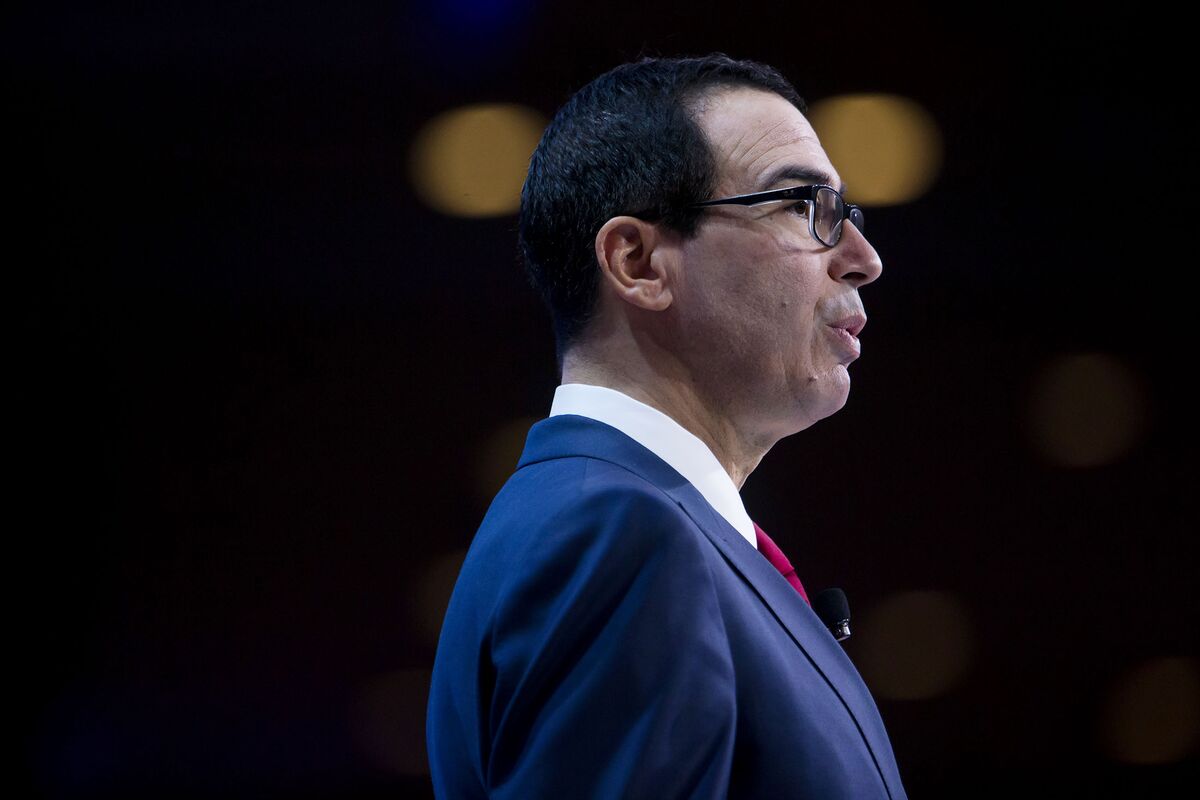

Treasury Secretary Steven Mnuchin got a swift rebuttal after he went on national television to claim a hypothetical Indiana family would save $1,000 under President Donald Trump’s tax plan.

It came from a fellow cabinet member. At virtually the same time on another network, White House Budget Director Mick Mulvaney dismissed as flawed any attempt to predict the impact of the plan on a particular family because so many essential details had yet to be determined.

“It is impossible to sit down and say, this will be the impact on this wage earner or this family at this particular time,” Mulvaney said on CNN’s State of the Union on Oct. 1, the same day as Mnuchin’s appearance on ABC’s This Week.

Inconsistent communication from the White House about how its tax plan would work and who would benefit risks undermining Trump’s campaign to build public support for his signature initiative. It also leaves lawmakers guessing about what the president wants -- or at least is willing to accept -- as Congress fills in the broad tax framework Trump and GOP leaders released last month.

Even Senate Finance Chairman Orrin Hatch, whose panel is responsible for drafting tax legislation, said in an interview Monday that he wasn’t certain of Trump’s red lines -- hours after the president shot down in a Twitter post a Republican idea to reduce annual limits on 401(k) retirement account contributions.

“We need to know what the president wants to do to try to coordinate it with him,” he said. “So far I’m not quite sure where he’s going.”

Thanksgiving Deadline

House Republicans hope to vote before Thanksgiving on a final plan, which they expect to unveil as soon as next week, said a senior party aide.

By then, contradictory statements from administration officials would threaten to weaken both the White House’s credibility and muddy its argument as Americans form crucial early perceptions.

“The Administration has always been clear and consistent on the top priorities for tax reform: giving middle-income Americans a tax cut and bringing the corporate rate down to 20% or lower,” White House Press Secretary Sarah Huckabee Sanders said in a statement. “We hope Democrats who have supported similar proposals in the past will put aside partisanship and support giving the middle class a major tax cut, American workers a pay raise, and our businesses of all sizes a level playing field to compete.”

The White House starts from behind with the public. Americans oppose the Trump tax plan by 52 percent to 34 percent, according to a CNN poll taken Oct. Only 24 percent believe they would be better off under Trump’s plan, according to the poll.

While Trump has repeatedly promised wealthy Americans wouldn’t benefit from the tax overhaul, Vice President Mike Pence has championed the plan as an “across the board” cut for all income levels. The White House branded the plan a “middle-class miracle” just hours before National Economic Council Director Gary Cohn said on ABC he couldn’t guarantee taxes won’t go up for some middle-class Americans.

Republicans have vacillated on how to treat state-and-local taxes and whether to add a higher tax bracket for top earners. Administration officials have made several conflicting statements about the effect on the deficit, ranging from predictions of debt-reducing growth to revenue neutrality to active advocacy for more debt.

“It’s a gong show,” said David Stockman, who served as budget director when President Ronald Reagan passed tax cuts in the 1980s. Stockman blamed “naïve cowboys” in the administration with scant Washington experience for the lack of message discipline.

Cut For Wealthy

Any shifts in messaging reflect the evolving nature of the legislative process, said a senior administration official, who requested anonymity to discuss internal deliberations.

The White House has especially struggled to combat claims that the tax proposal is geared toward the wealthy. Despite being one of the most predictable lines of attack, the Trump administration has offered shifting defenses, with officials often contradicting themselves.

Trump unveiled the framework during a Sept. 27 speech in Indianapolis, with bold claims that the benefits of the plan would flow to the middle class, “not the wealthy and well-connected.” He used himself as an example to drive home the point.

“I’m doing the right thing, and it’s not good for me, believe me,” he said.

The claim was rejected by independent analysts and economists, who have said that part of the plan -- which would also slash the top tax rate on certain business income to 25 percent to 39.6 percent -- does stand to benefit owners of lucrative partnerships and limited liability companies, including Trump himself. Administration officials have since tried to push back.

“Wealthy Americans are not getting a tax cut,” Cohn said Sept. 28 on ABC’s “Good Morning America” program.

Mnuchin’s Message

“The objective of the president is that rich people don’t get tax cuts,” Mnuchin said Oct. 1 on ABC’s “This Week” program.

But Mnuchin has since walked back his statement, pointing out that the rich pay most U.

“When you’re cutting taxes across the board, it’s very hard not to give tax cuts to the wealthy with tax cuts to the middle class,” he said in an interview that aired Wednesday on Politico’s “Money” podcast.

It wasn’t the first time Mnuchin had undercut the administration’s previous message by acknowledging that the wealthy would benefit from elements in the tax plan. 13, he said Trump’s proposed repeal of the estate tax would help the rich.

“The estate tax, I will concede, disproportionately helps rich people,” Mnuchin said during a speech to the Institute for International Finance conference.

‘Wonderful Farms’

The statement came after the administration spent weeks trying to portray the tax--which is currently paid by only a few thousand wealthy estates annually--as the bane of small family-owned businesses and working-class farmers. Cohn insisted to reporters on Sept. 28 that the wealthiest Americans use sophisticated estate planning to avoid paying the tax altogether.

Under current law, a married couple’s estate is exempt from paying inheritance taxes on the first $10.98 million, rising under an inflation index to $11.

“The farmers in particular are affected,’’ Trump said on Sept. “They have wonderful farms, but they can’t pay the tax, so they have to sell the farm.”

Trump’s lack of focus and the lack of details on the plan’s benefits for the middle class will make it harder for Republicans to succeed in overhauling the tax code this year, said Stockman, Reagan’s budget director. He predicted the plan will fail.

“There’s not going to be a tax bill. That’s just the reality of the measure,” he said.

— With assistance by Laura Litvan, and John Voskuhl.

0 comments:

Post a Comment