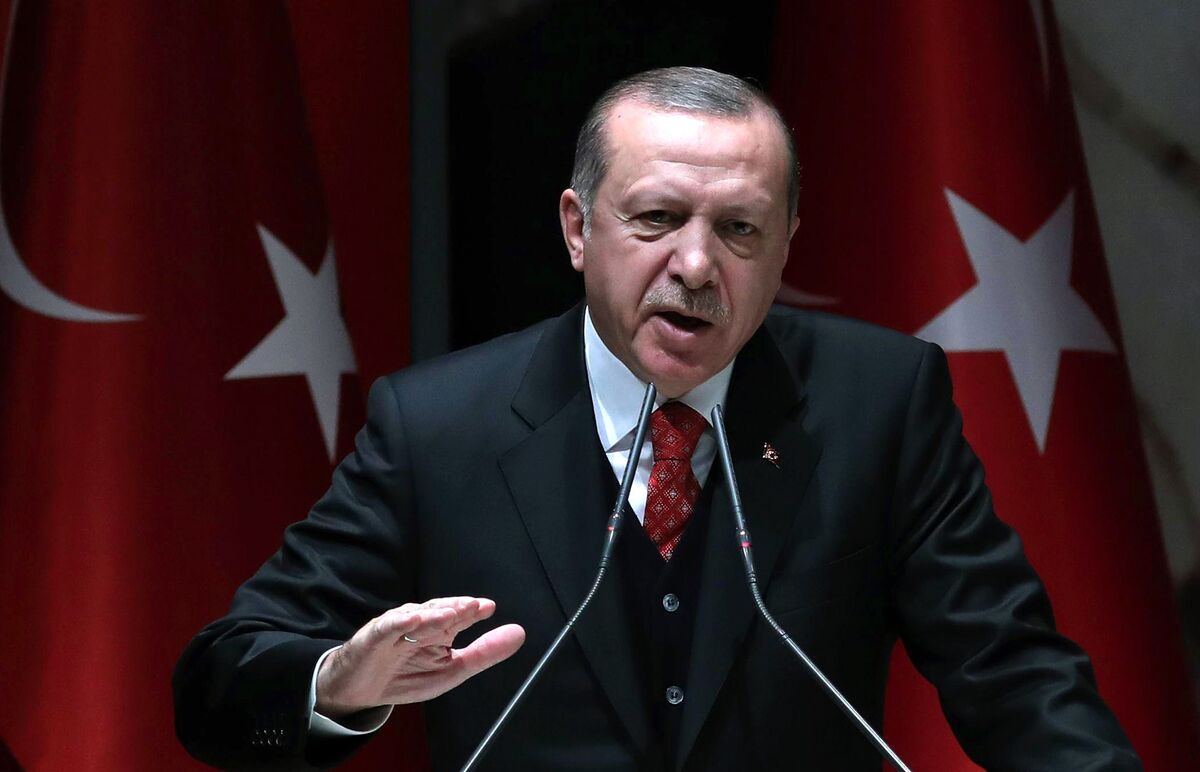

Turkey’s President Recep Tayyip Erdogan has urged the cabinet to take measures against the smuggling of wealth abroad by “some businessmen,” saying the attempt constitutes treason against the state.

“I am hearing that some businessmen are in an effort to smuggle their wealth abroad. I am calling on our cabinet, first and foremost, that you should not allow any of it to leave because these moves constitute treason against the state,” Erdogan said in a speech from the eastern province of Mus on Sunday.

Erdogan did not name any businessmen or companies, but his equation of their transfer of wealth abroad with “treason” builds on his allegations of an international conspiracy against his government, more than a year after a coup attempt. A Turkish banker is on trial in New York, charged with helping Iran to evade U. financial sanctions, while some of the president’s relatives have been accusedby the country’s main opposition party of transferring millions of dollars abroad. Erdogan has denied the allegations against his family members as “slander.”

“We don’t look favorably upon those who are making money in this country and attempting to smuggle their wealth abroad,” Erdogan said.

Since the July 2016 coup attempt, the government has been using incentives, tax breaks and fiscal stimulus to support economic growth, which is expected to be the fastest in the world in the third quarter. Still, many see Turkey’s market as saturated,cluttered with red tape and expensive for acquisitions. Turkish companies may spend a further $64 billion on overseas acquisitions and setting up new operations abroad by 2023, Volkan Kara, a partner in Bain & Co.’s Turkey office, said in a recent report.

“Turkey is a free-market economy and our citizens can invest abroad the same way foreigners invest in Turkey. Seeing this as treason could have consequences: other countries may implement similar measures against us,” Atilla Yesilada, an economist at New York-based consultancy GlobalSource Partners, said by phone on Monday from Istanbul.

If the government decides to introduce capital controls, “we could see the Turkish lira getting hit again,” Yesilada added.

The lira traded 0.6 percent lower against the dollar at 3. in Istanbul after consumer inflation hit its highest level since 2003, according to Turkey’s state statistics institute.

Turkey’s foreign direct investment outflows slowed to $1.83 billion dollars in the first nine months of 2017, set for the lowest annual pace since 2010, according to central bank data. Outflows reached a record $7.

0 comments:

Post a Comment