Lawmakers’ next task is to reach compromise on provisions

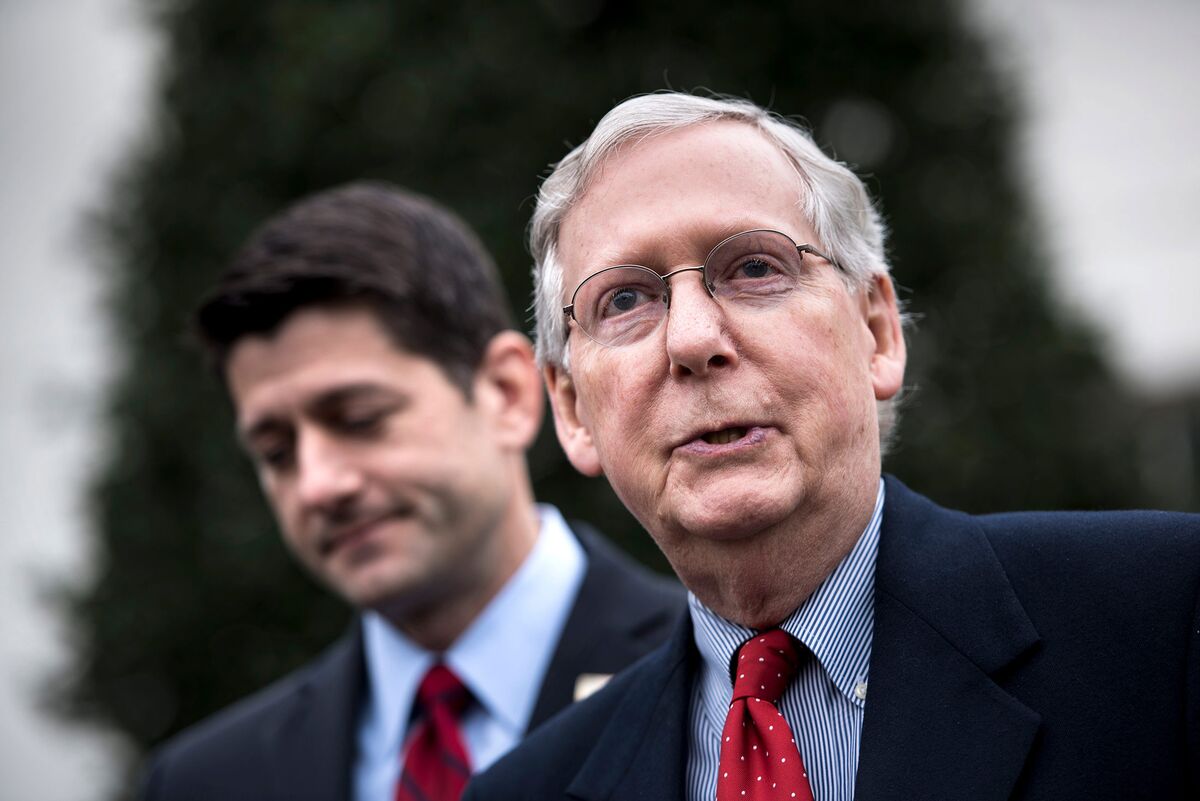

Speaker of the House Paul Ryan listens while Senate Majority Leader Senator Mitch McConnell speaks to the press after meetings with President Donald Trump at the White House on Feb.

Expiring tax cuts, business perks and health care politics loom over House and Senate Republicans as they face the daunting task of hammering out the differences between their competing bills to rewrite the U.

Different versions of the bill passed the Senate and House with only Republicans’ votes, and the GOP can’t afford to lose too many supporters in the negotiations as they seek a compromise. The party can spare only 22 votes in the House and two in the Senate.

There’s a lot they agree on. For example, they both would cut the corporate tax rate to 20 percent from 35 percent -- though the Senate version would make that change in 2019, a year later than the House bill would.

But there are some major differences that won’t be easy to resolve, and any changes could increase the bill’s cost or force painful tradeoffs. Here are the biggest sticking points -- and how they may be resolved.

Temporary Tax Cuts

House: A $300 per person family credit sunsets after 2022.

Senate: All individual tax breaks -- including rate cuts and the doubling of the standard deduction -- expire after 2025. A planned repeal of state and local deductions for income and sales taxes would also end then, and personal exemptions automatically return after 2025.

Pass-Through Tax Breaks

House: Pass-through business income is taxed at 25 percent, with some limits. A lower rate of 9 percent is also available for some lesser-earning businesses.

Senate: Pass-through income gets a 23 percent deduction, subject to limitations, including the same expiration date -- end of 2025 -- as the individual tax provisions.

Alternative Minimum Tax

House: Repeals it entirely for both individuals and corporations.

Senate: Maintains it, but raises the individual exemptions until 2026. Corporate AMT would remain in full.

Obamacare Individual Mandate

House: No action on the mandate.

Senate: Effectively repeals the mandate by zeroing out the tax penalty for individuals who don’t purchase health insurance.

Business Expensing

House: Full and immediate expensing on equipment purchases that expires in five years.

Senate: A “step-down” approach that phases out the expensing benefit after five years rather than an immediate cliff.

Mortgage Interest Deduction

House: Cuts the deduction cap for new purchases of homes in half -- to loans of $500,000.

Senate: No change to the current $1 million limit.

Individual State and Local Tax Deductions

House: Repealed, with a property tax exemption up to $10,000.

Estate Tax

House: Limits the number of multimillion-dollar estates that would pay the tax by doubling the threshold at which it applies, then fully repeals the levy in 2025.

Senate: Doubles the exemption amount until 2026, then reverts to lower thresholds.

0 comments:

Post a Comment